MANAMA, BAHRAIN – 9 May 2015 – Ithmaar Bank, a Bahrain-based Islamic retail bank, reported today (ed note: 9/05/15) a net profit of US$7.62 million for the first quarter of 2015, a 261 percent increase over the US$ 2.11million net profit reported for the same period last year.

Net profit attributable to equity holders of the Bank for the first quarter of 2015 was US$2.64 million, a 426 percent increase over the US$0.5 million profit reported for the same period last year.

The announcement, by Ithmaar Bank Chairman His Royal Highness Prince Amr Al Faisal, follows the review and approval, by the Board of Directors, of the Bank’s consolidated financial results for the three-month period ended 31 March 2015.

“On behalf of the Board of Directors, I am pleased to announce that Ithmaar Bank’s business continues to grow, and that the first quarter financial results reflect the improvement in the Bank’s financial performance,” said HRH Prince Amr. “The Bank’s operating income has significantly increased by almost 46 percent to US$83.34 million for the first quarter of 2015, from US$57.13 million for the same period last year. This increase is mainly due to overall revenue growth, with net income, before provisions for impairment and overseas taxation, for the period increasing 292 percent to US$34.4 million,” he said.

“Total expenses of US$48.94 million for the three-month period ended 31 March 2015, are near constant compared to US$48.35 million for the same period last year, due to cost control measures which started in 2014 both in Bahrain and in Faysal Bank Limited, Pakistan, despite the continued branch expansion in Pakistan” said HRH Prince Amr.

“I am also pleased to report that the balance sheet continues to be stable with the equity of unrestricted investment account holders growing to US$2.09 billion as at 31 March 2015, an increase of 4.18 percent compared to US$2.00 billion as at 31 December 2014,” he said. “This significant increase during the first quarter is further evidence of customers’ continued confidence in Ithmaar Bank.,” said HRH Prince Amr.

Ithmaar Bank Chief Executive Officer, Ahmed Abdul Rahim, said the Bank’s focus on retail business has resulted in improved financial results for the first quarter of 2015.

“Total assets grew to US$8.06 billion as at 31 March 2015, an increase of 7.18 percent compared to US$7.52 billion as at 31 March 2014 and increase of 2.49 percent compared to US$7.86 billion as at 31 December 2014,” said Abdul Rahim. “Liquid assets now represent 12.7 percent of the balance sheet compared to 11.3 percent as at 31 December 2014,” he said.

“The Bank’s improving financial results indicate that the Bank is on path to realise its vision of becoming one of the region’s premier Islamic retail banks,” said Abdul Rahim. “To do so, we strive to enhance our customer satisfaction by continuously improving our products and services and thereby growing closer to our customers,” he said.

Ithmaar Bank recently introduced “Ithmaar Rewards”, a new rewards programme for its MasterCard credit card holders. This rewards programme is by far the most comprehensive of its kind and is Bahrain’s most rewarding loyalty programme, which promises to significantly improve the Ithmaar Bank customer experience. The world-class loyalty programme allows Credit Card holders to redeem points online and choose from 700 airlines, 150,000 hotels and car rental service without restrictions or blackout dates and inclusive of all taxes.

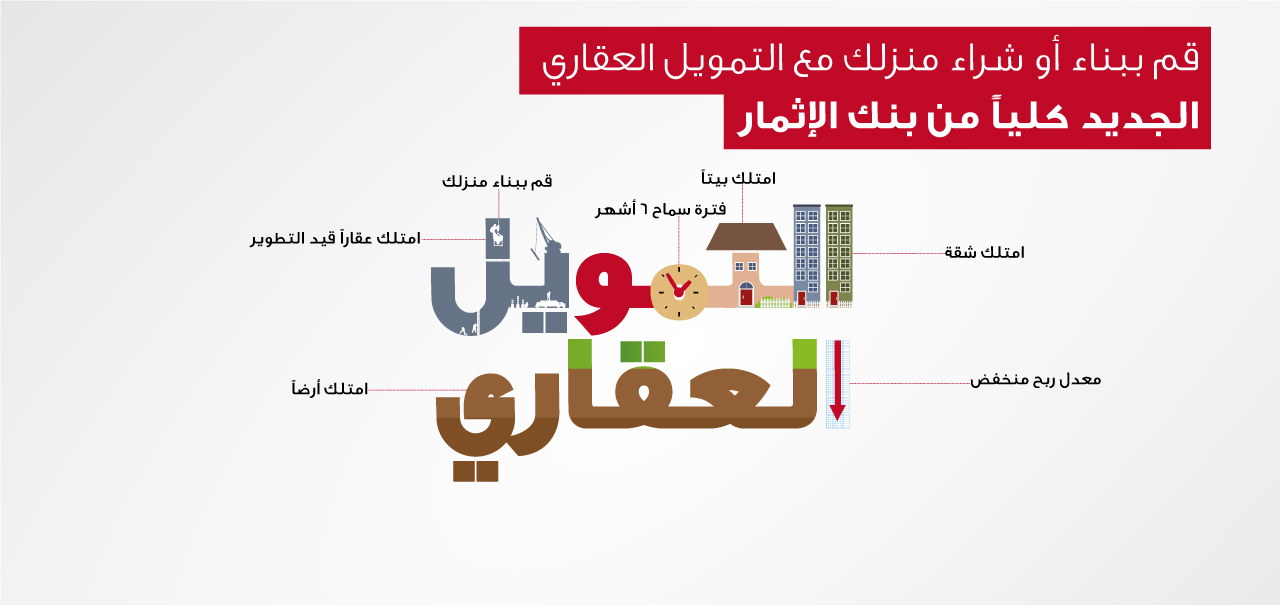

Earlier this year, Ithmaar Bank also introduced a number of financing solutions - including auto, home and personal finance offerings – that were tailored specifically to meet customer demands.

Ithmaar Bank also announced that it’s award-winning card-less cash solution, MobiCash, will be provided to customers without a service charge. MobiCash is Bahrain’s first card-less cash withdrawal system and allows customers access to Ithmaar Bank Automated Teller Machines (ATMs) using their mobile phones or computers.