MANAMA, BAHRAIN – 16 August 2014 – Ithmaar Bank, a Bahrain-based Islamic retail bank, announced today a net profit of US$1.77 million for the first half of 2014, as compared to the net loss of US$7.52 million reported for the same period last year. Net loss for the three month period ended 30 June 2014 amounted to US$0.34 million, as compared to net loss of US$8.95 million reported for the three month period ended 30 June 2013.

Net loss attributable to equity holders of the Bank amounted to US$0.11 million for the first half of 2014, as compared to the net loss of US$7.64 million reported for the same period last year. Net loss attributable to equity holders of the Bank for the three month period ended 30 June 2014 amounted to US$0.61 million, as compared to net loss of US$9.49 million reported for the three month period ended 30 June 2013.

The announcement, by Ithmaar Bank Chairman His Royal Highness Prince Amr Al Faisal, follows the review and approval, by the Board of Directors, of the Bank’s consolidated financial results for the six-month period ended 30 June 2014.

“On behalf of the Ithmaar Bank Board of Directors, I am pleased to announce that Ithmaar Bank continues to grow its core retail banking operations during the second quarter,” said HRH Prince Amr. “This is illustrated in the financial results that show revenue growth across most income streams,” he said.

“Our improved performance is evident from the growth in operating income, which increased by 17.68 percent to US$114.88 million from the US$97.61 million reported for the same period last year,” said HRH Prince Amr. “Total expenses for the first half of 2014, at US$100.56 million, are 5.42 percent higher than the same period in 2013, mainly due to the one-off expenses associated with the Voluntary Separation Scheme and the full year impact in 2014 of certain branches opened in 2013 in Pakistan,” said HRH Prince Amr.

“I am also pleased to report that the balance sheet continues to be stable,” said HRH Prince Amr. “The equity of unrestricted investment account holders has increased by 9.1 percent to US$1.97 billion as compared to $1.80 billion as at 30 June 2013 and has remained stable at US$1.99 billion as of 31 December 2013. Customer current accounts have increased to US$1.49 billion as at 30 June 2014, an increase of 19.08 percent compared to US$1.25 billion as at 30 June 2013 and increase of 17.61 percent compared to US$1.27 billion as at 31 December 2013, mainly due to the Bank’s continued focus on developing its core retail banking business and raising low cost funds,” he said.

Ithmaar Bank Chief Executive Officer, Ahmed Abdul Rahim, said the 2014 half-yearly financial results show stable, consistent growth in the Bank’s core Islamic retail banking operations and reflect improving efficiencies and increasing profitability.

“The financial results demonstrate the success of our ongoing efforts to develop core Islamic retail banking operations and resultant recurring income. Murabaha and other financing continues to increase, and amounted to US$3.31 billion as at 30 June 2014, an increase of 4.81 percent from US$3.15 billion as at 30 June 2013 and increase of 4.84 percent from US$3.15 billion as at 31 December 2013, expenses are under control and the impact of cost reduction measures implemented during the year will be realized in full during 2015” said Abdul Rahim. “Liquid assets now represent 13.77 percent of the Bank’s total assets as at 30 June 2014,” he said.

“The results also indicate that board initiatives to enhance the group’s performance in 2014 are paying off, and that the Bank is continuing to work towards realising its vision of becoming one of the region’s premier Islamic retail banks,” said Abdul Rahim. “We are doing so by listening closely to our customers with focus on enhancing service quality and developing both our products and our services to meet their specific requirements and continuously improve their Islamic retail banking experience,” he said.

“Ithmaar Bank has one of the largest distribution networks in Bahrain with a total of 17 branches and 48 ATMs in strategic locations, and our key subsidiary, Faysal Bank Limited (FBL), with its 269 branches, is amongst the top 10 banks in Pakistan,” said Abdul Rahim. “Our large network of retail banking branches allows us to grow closer to our customers while we work on continuously enhancing our products and services,” he said.

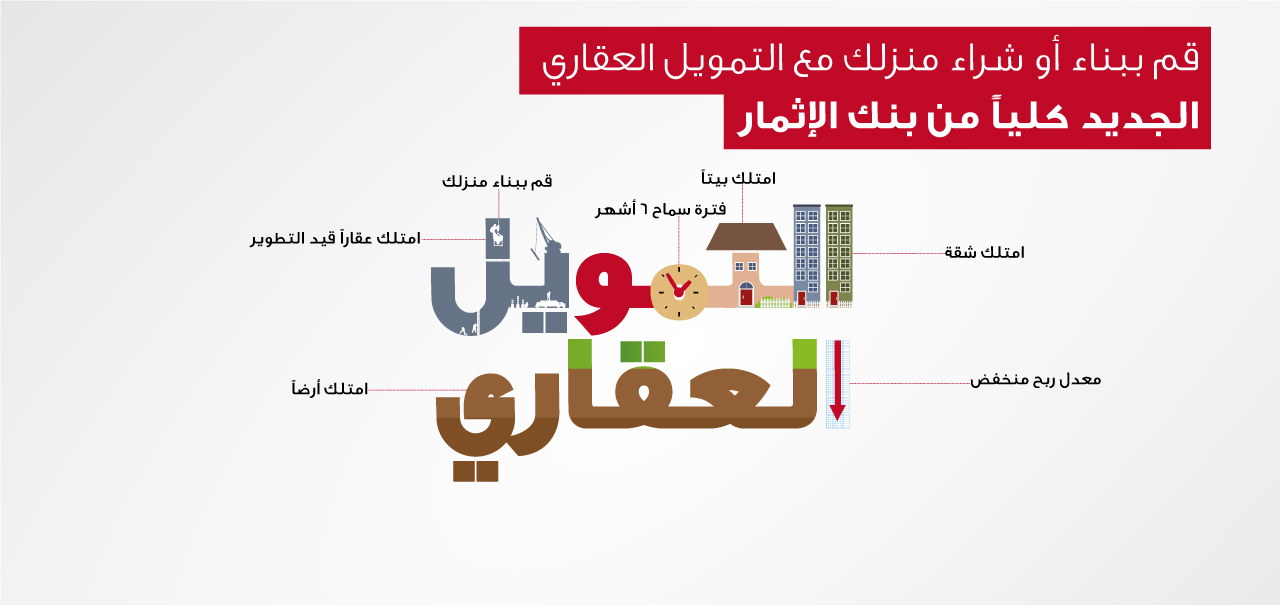

Ithmaar Bank has recently introduced a full suite of new MasterCard credit card solutions, as well as new personal and auto finance products designed specifically to meet customer requirements.

Most recently, Ithmaar Bank signed a partnership agreement with the Bahrain Ministry of Housing and Eskan Bank to help address the Kingdom’s housing challenges. Under the agreement, Bahraini citizens will be offered government-subsidised financing through Ithmaar Bank to help them buy their first homes as part of a national scheme designed to address the Kingdom’s housing challenges. The Social Housing Financing Scheme allows eligible citizens to finance their first homes through Ithmaar Bank by paying 25 percent of their monthly income towards the property’s monthly instalment with the rest being paid for by the Ministry of Housing through Eskan Bank.